La seguridad en Bnext

En Bnext estamos muy comprometidos con la seguridad de la información y las transacciones de nuestr@s usuari@s. Por eso, hemos preparado estas recomendaciones para prevenir y mitigar el ciberfraude

En Bnext estamos muy comprometidos con la seguridad de la información y las transacciones de nuestr@s usuari@s. Por eso, hemos preparado estas recomendaciones para prevenir y mitigar el ciberfraude

El ciberfraude consiste en el robo de datos personales, normalmente bancarios, con la finalidad de causar un perjuicio económico.

Estos fraudes se cometen a través de diferentes medios, como sms, emails o llamadas suplantando la identidad de una entidad bancaria o cualquier otra compañía indicando, por ejemplo, que debes proporcionar los datos de tu tarjeta Bnext.

De 4 a 6 dígitos, únicamente modificables por el propio usuario, o través de reconocimiento facial

Las contraseñas y PIN de las tarjetas se guardan encriptados, por lo que nadie tiene acceso a ellos

Notificación de manera instantánea de cada compra realizada, salvo que desactives esta opción

Posibilidad de bloqueo de tarjeta en cualquier momento, desde la propia App o a través de nuestra web

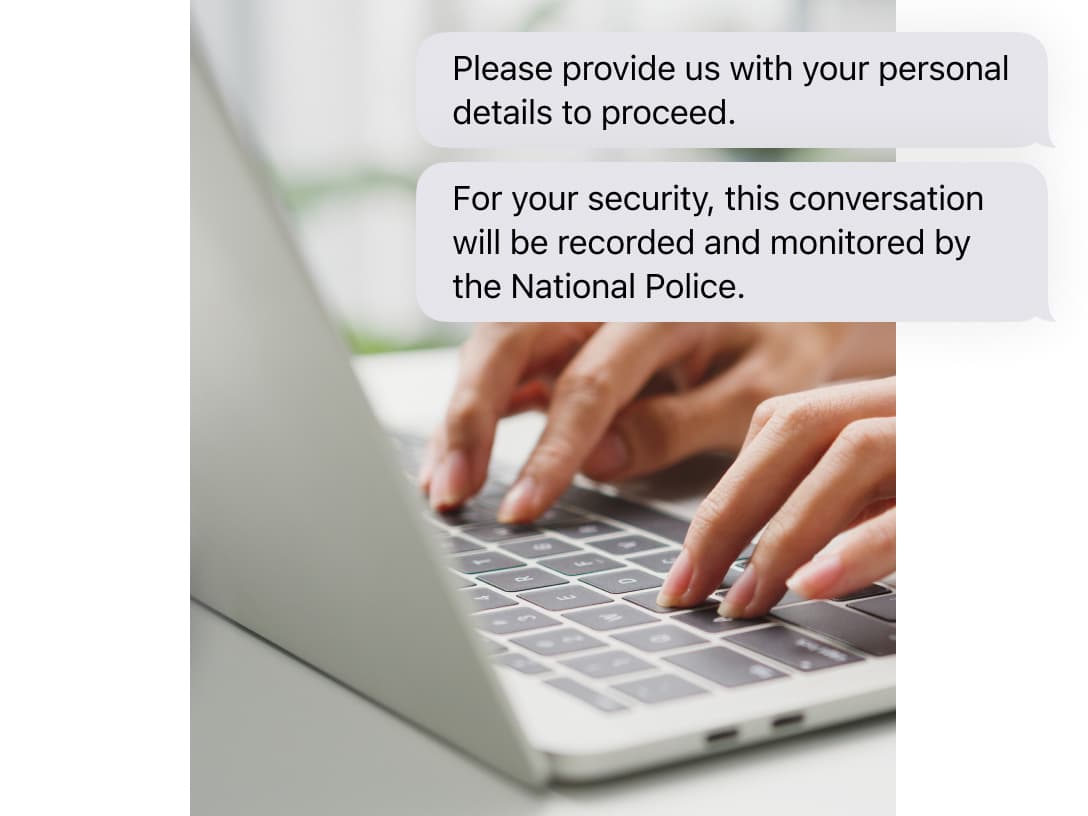

El atacante, a través de email o sms, intenta suplantar a una empresa utilizando una dirección de e-mail similar a la oficial, copiando su logo, textos, etc.

Se utilizan números telefónicos fraudulentos, software de modificación de voz e ingeniería social para engañar a los usuarios

El código QR es modificado de forma maliciosa y, al acercar el móvil y leer ese código se nos redirecciona a un sitio web falso que pone en riesgo nuestra seguridad

Te enumeramos a continuación los casos más comunes de ciberfraude que se cometen en la actualidad

Mediante Apps o webs aparentemente legales, pero que son clonadas de manera muy similar a las originales

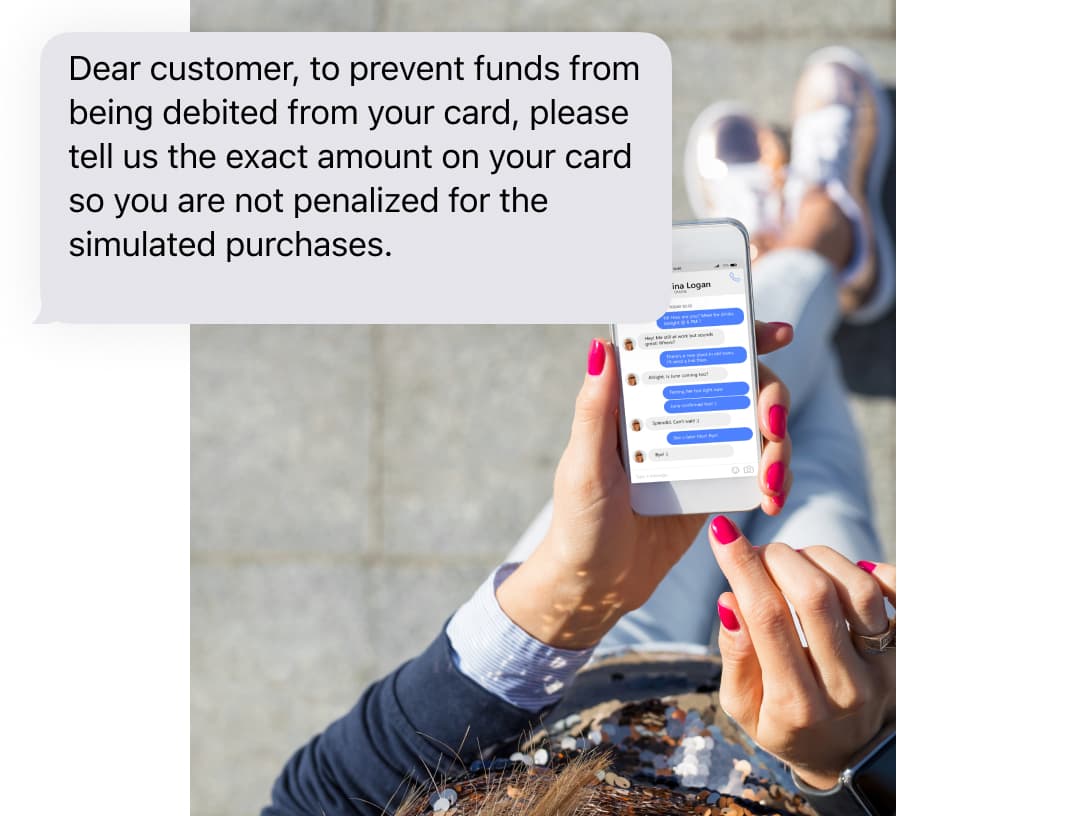

Por plataformas de venta de segunda mano, a través del chat con el comprador/vendedor

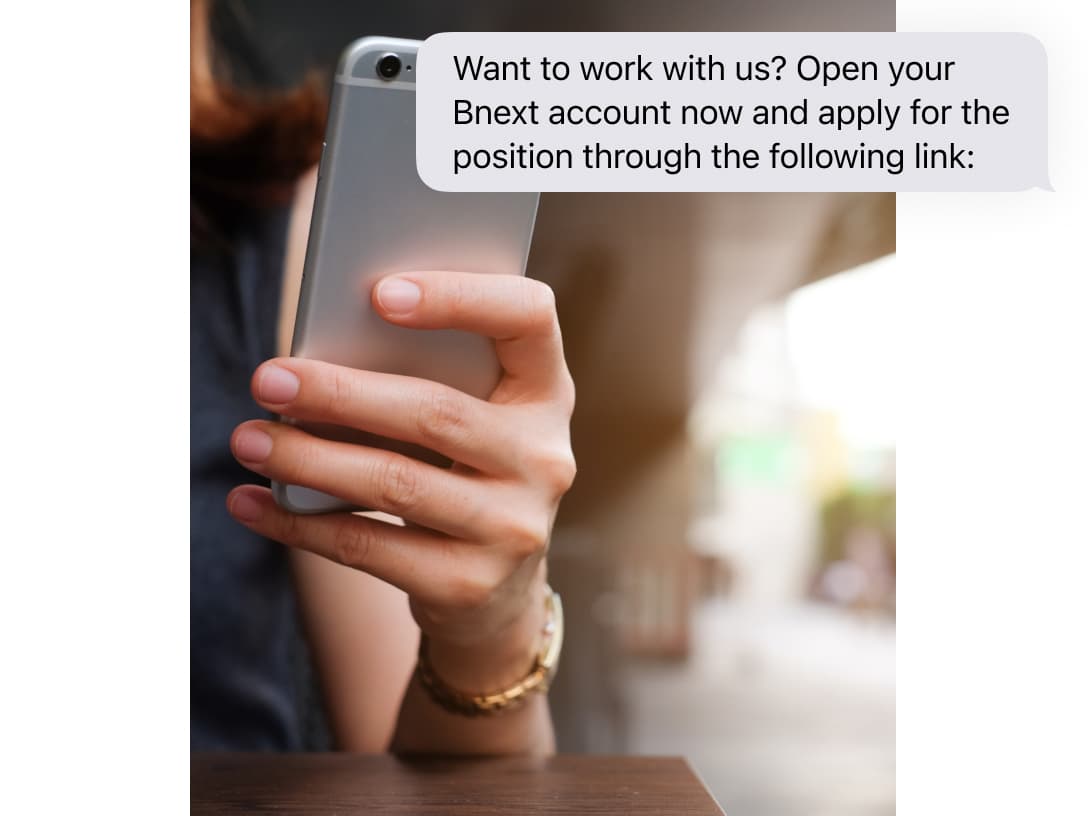

Es una práctica frecuente para ofrecerte un trabajo que no existe y así recoger tus datos personales.